Fortunately, most members of the police services should have a reasonably good pension pot by the time they come to retirement so you don't have to rely solely on the state pension.

But for some beginning to look ahead to retirement, some cold hard realities may be starting to dawn. Namely the gap between what they would LIKE to be living on in retirement – and what they WILL be living on. That's why it is never too early to start planning your retirement.

Here are a few tips that will help your retirement reality live up to your dreams.

1. Research your pension pot options

Start understanding and researching the ways to convert your pension savings into income streams. One of the ways of doing this is with annuities (remember to shop around for the best annuity rates), or you may want to think about investments in property, shares or even businesses.

It's important to learn more about these options so you can have an income from the first day you retire. You should also be aware of the pros and cons that come with the newly available Pensions Freedom arrangement, whereby it is possible to access in part or in full (first 25% is tax-free) certain types of private pensions.

It may be wise to consult an Independent Financial Advisor to get better informed on your pension pot options.

2. Pay off your debts

Aim to pay off your debts before you retire. Needless to say when your income gets drastically reduced you don’t want to still be paying off debts.

Assess all your debt now and make a plan to pay all of it off as soon as you can – ideally before you retire. To help you pay debt off faster, make sure you are paying the lowest interest rate you can get. Consolidating debt or transferring to interest free credit cards are all options.

3. Find out how much you will be getting

You may have many different pension income streams coming to you from various schemes, so it can be difficult to pin down just how much your regular monthly income will be in retirement.

Start by finding out how much you will receive from the State Pension by using the State Pension Checker. You may also have some money remaining in long-forgotten pension schemes from a former workplace or other source. These are known as ‘lost pensions’ and you can find out more about them from The Pension Advisory Service.

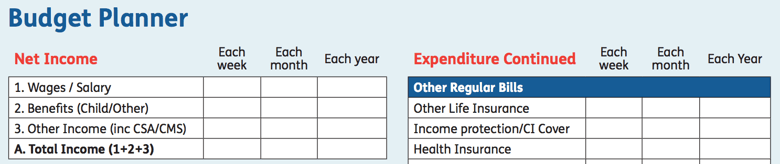

4. Make a retirement budget

You probably have a budget for your present life, but how many have one for their future circumstances? While it can be hard to calculate many years ahead, try to make a budget for when you are actually retired. What will you be spending each month and what will your income be?

Download our comprehensive budget planner

5. Find out about tax

Tax can be complicated whether you're in employment or in retirement. With various income streams and pensions in play, a possible retirement lump sum, a move to a different tax code – things can get messy very quickly. And mistakes can turn out to be very costly. So don’t wait until retirement.

Find out all you can now about the tax issues involved with retirement and pensions, then make a personal plan to deal with them so you don’t end up paying more than you need.

Share