Invest a lump sum

Investing with us is a great way to look after your money and see it grow.

Special Offer

Get up to a £500 Instant Loyalty boost added to your initial investment – Plus a £50 Amazon.co.uk Gift Card when you invest or transfer £10,000 or more by 5th April 2026.

| Investment Value | Amount added to your Plan |

| £10,000 – £19,999 | £100 |

| £20,000 – £29,999 | £200 |

| £30,000 – £39,999 | £300 |

| £40,000 – £49,999 | £400 |

| £50,000 or more | £500 |

Quote code: Offer26. Terms and Conditions apply.

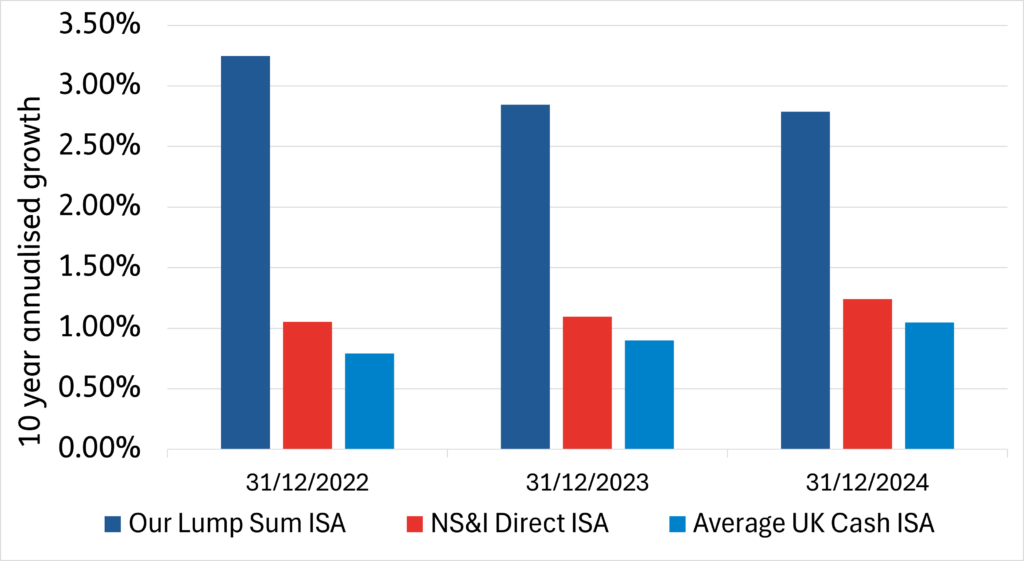

10 year annualised growth ISA performance comparison

Double the returns of a cash ISA

Our 10 year annualised has outperformed the returns of an average Cash ISA by up to 2.5% over the past 3 years. See how our Lump Sum ISA performed compared to the NS&I Direct ISA and average UK Cash ISA.

Past performance is not a reliable guide to future returns.

Choose between a guaranteed growth rate or the addition of annual and final bonuses.