Open a new plan with our special offer

Receive a £25 Amazon.co.uk Gift Card when you open a new Ten Year Savings Plan by 31st July 2025.

Quote code UK2025. Terms and conditions apply.

We’ll donate £10 to the Police Remembrance Trust for every new plan opened by 31st July.

The Ten Year Savings Plan

If you want a simple, long-term savings plan that you can’t dip in and out of then this is ideal for you.

- monthly premiums start at just £25

- you can save up to £300 a month

- your savings earn annual bonuses and normally a final bonus on encashment

- guaranteed lump sum after 10 years

- your first £25 a month savings can go into a Tax Exempt Plan

- Metfriendly does not pay tax on the income and capital gains made for the Tax Exempt Plan – so we can pay higher bonuses

- after 10 years, you can get the total value of your plan paid to you or leave it invested with Metfriendly to grow

- ‘Rolling Plan’ option gives you a pay-out every year (after the first ten years)

NOTE: You can request the first £25 of your monthly premium to be tax-exempt if you are not paying into a tax-exempt plan elsewhere. The tax-exempt part of your savings will be issued as a separate contract.

Watch this video for a quick summary of our Ten Year Savings Plan.

Rolling Plan

Many of our members also choose to start new plans every year. This can be set up automatically and is known as the Rolling Ten Year Savings Plan and means that after ten years you will start receiving a pay-out every single year – ideal for regular annual events like Christmas, school fees or holidays. See “What is the Rolling Ten Year Savings Plan?” below for full details.

What returns has this plan produced?

1.3%

£25 per month 10 Year Savings Plan (taxable) cashed in on 1st January

Annualised return for 10 years to 1st January 2025

Where is my premium invested?

The premiums are invested in the Metfriendly With-Profits fund. For information on what that is and how it works, including a diagram to show the approximate investment mix, please refer to the With-Profits fund page.

Can I cash in earlier?

Yes. The plan can be cashed in for a surrender value at any time. You can only cash in the plan completely – we will not permit part surrenders. Once you have been paying premiums for 6 years, the surrender value may exceed what you have paid in – but it could be less in the early years. The surrender value reflects our investment return over the period of your savings. On taking money out of either plan there may be tax implications – see ‘What about tax?’ in the key features document.

What if I change my mind or decide to cancel?

- You can cancel for a full refund within 30 days of receiving your policy documents. Simply contact our Member Services team on 01689 891454 or email [email protected]

- If you wish to stop or cancel your plan after this, remember this type of plan is fixed and penalties may apply. Our friendly Member Services team will be able to discuss your options.

How much will it cost for advice?

- We do not offer or give financial advice.

- Metfriendly does not make any form of commission.

- The cost of providing verbal or written information about these plans is included in Metfriendly’s overall expenses.

How do I contact you?

Metfriendly, Central Court, Knoll Rise, Orpington, BR6 0JA

Phone: 01689 891454

Email: [email protected]

What is the Rolling Ten Year Savings Plan?

- a new plan automatically begins each year

- after ten years your plans begin to pay out every year

- ideal for regular yearly expenses such as your annual holiday, Christmas or the start of the school year

- you can opt out of the Rolling Plan at any time

Rolling Plan Example

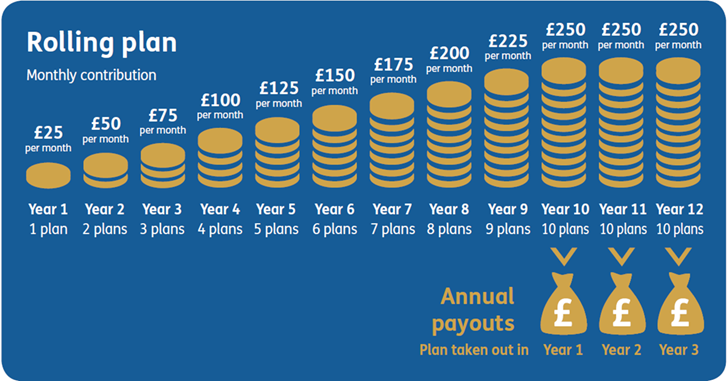

This example shows how you may set up a Rolling Plan to get a pay-out every January to help with Christmas credit card bill or holiday planning.

- you begin a Rolling Ten Year Plan in January at £25 per month.

- each subsequent year you begin another plan at £25 per month.

- after ten years you will have ten plans running for a total premium of £250 per month.

- after ten years your first plan will mature paying you the sum assured plus any annual bonuses and normally a final bonus, in good time to help you with the Christmas credit card bill or help towards a holiday.

- we’ll start a new plan for you after the first ten years to replace the matured one – that way you’ll continue to have ten plans running.

- early the following January your second plan will mature, again paying you the sum assured plus any annual bonuses and normally a final bonus – Christmas and holiday costs sorted again!

- and every January thereafter you will receive a pay-out for as long as you wish to carry the Rolling Ten Year Savings Plan on.

- you will only be able to open new plans until you reach age 55 (50 for a smoker).

The image below gives an example of how the rolling plan works.

To take out a Rolling Plan tick the relevant box in the application form.

Taking one out means that we will send you a new policy schedule each year, along with a cancellation notice giving you the option not to proceed with any further plans.