This plan is very simple. Save a regular amount for five years and get a return that’s guaranteed.

- minimum premium of just £20 a month

- easy deduction from salary or by direct debit

- you know exactly what you’ll get back after five years (or if you have to cash in early)

- ‘Rolling Plan’ gives you a pay-out every year (after the first five years)

Watch this video for a quick summary.

What will I get back?

As an example, under this plan a regular premium of £50 per month (£600 per year, £3,000 in total) will be guaranteed a return of £3,050 after five years.

This is effectively your total premiums paid PLUS a month’s premiums.

Rolling Plan

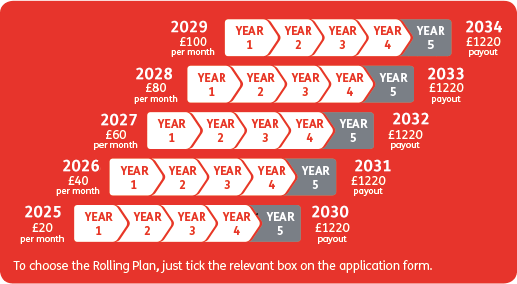

Many of our members also choose to start new plans every year. This means that after five years you will start receiving a pay-out every single year.

It’s ideal for regular annual events like Christmas, school fees or holidays.

You can stop “rolling” your plan at any time.

Rolling Plan Example

This example shows how to set up a Rolling Plan to get a pay-out every January.

- you begin a Rolling Five Year Plan in January at £20 per month

- each subsequent year you begin another plan at £20 per month

- after five years you will have five plans running for a total premium of £100 per month

- after five years your first plan will mature paying you a GUARANTEED £1,220

- early the following January your second plan will mature paying you another GUARANTEED £1,220 – Christmas paid for, again!

- and every January thereafter you will receive a pay-out for as long as you wish to continue your rolling plan.

Simply tick the option when you apply. We will send you a new policy schedule each year, along with a cancellation notice giving you the option not to proceed with any further plans.

Got a question?

Visit our help centre, request a call back, or call us on 01689 891454. Lines open 08:30 to 17:00 Monday to Thursday and 08:30 to 16:30 on Friday.